As California advances its mileage based road charge, the program reveals itself as more than a funding mechanism. It establishes a system designed to record, verify, and bill movement itself. While state agencies frame the effort as modernization and fairness, the structure converts driving into a monitored and reportable activity tied directly to personal identity. What is described as a pilot functions as a prototype for permanent mileage monitoring.

The road charge effort is led by the California State Transportation Agency and Caltrans through a multi year program authorized by Senate Bill 1077 in 2014 and extended by Senate Bill 339 in 2021. The stated purpose is to stabilize transportation revenue as fuel tax collections decline due to electric and hybrid vehicle adoption.

As of October 2025, the program remains in a pilot and data gathering phase. No statewide mandate or rate schedule has been enacted. Caltrans has nonetheless developed the administrative and technical framework required for full implementation. The pilot establishes reporting methods, account structures, billing processes, and enforcement pathways that would be used in a mandatory system.

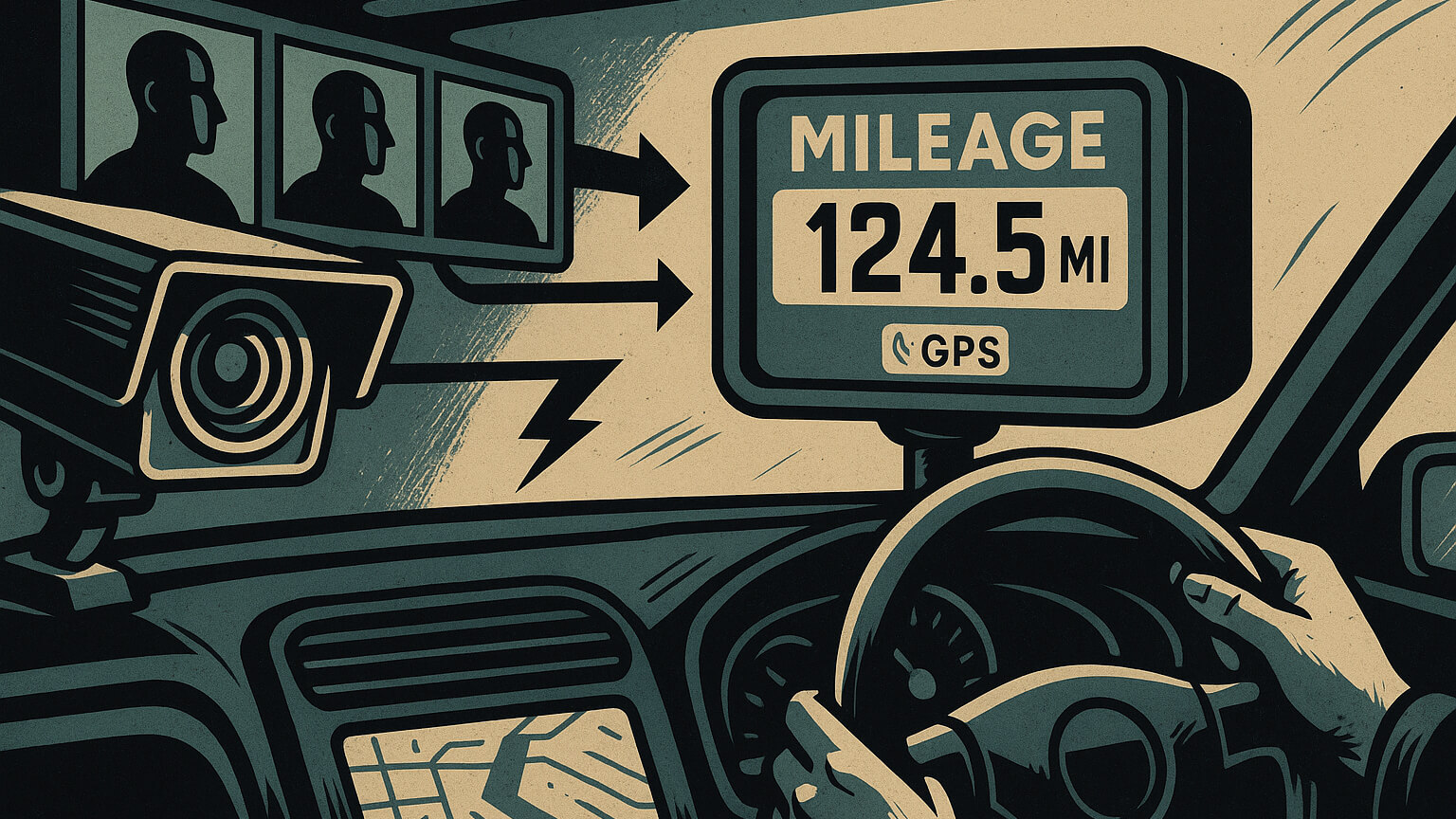

Unlike the gas tax, which is collected anonymously at the point of fuel purchase, the mileage based charge attaches directly to the driver and vehicle. Tax liability is assessed through direct reporting of distance traveled rather than through consumption. State materials describe multiple reporting options, including manual odometer verification, plug in diagnostic devices, smartphone applications, and GPS enabled telematics systems capable of separating in state from out of state travel.

Manual reporting requires drivers to submit verified odometer readings during registration renewal or at scheduled intervals through an online portal, in person, or via timestamped photographic submission. Automated reporting relies on devices or applications that collect mileage data and transmit it to Caltrans or approved third party account managers.

Once mileage data is received, the state or its contractor calculates the charge, generates an invoice, and collects payment electronically. Billing may occur quarterly, annually, or through automatic deductions. Non reporting or non payment would be enforced through administrative penalties such as fines, late fees, or registration holds, using mechanisms already employed for toll enforcement and vehicle fee collection.

Participation requires identity verification regardless of reporting method. Every vehicle must be linked to a registered account containing identifying information. While Caltrans states that location data will not be retained, several approved reporting options rely on GPS capable systems. The technical capacity to collect time, location, and route data exists within the system architecture. Privacy protections described by the state are procedural rather than structural.

The mileage charge restructures taxation around the act of driving itself. Mobility becomes a taxable event requiring documentation, verification, and ongoing compliance. The change replaces incidental collection with individualized accounting.

SB 339 authorizes data collection explicitly for future legislative design. The program prepares recommendations for statewide implementation. Current statutes provide no broad exemptions and contain no defined limits on data retention, inter agency sharing, or secondary use. Enforcement would rely on existing registration and compliance systems.

Once implemented, the road charge would require continuous participation. Drivers would be obligated to register, report mileage, submit data, and pay assessed charges. Anonymity in road use would no longer exist. Each mile would be logged, audited, and billed.

The system enables future expansion into variable rates by region, time, vehicle type, congestion level, or emissions category. Such changes could be implemented administratively once the infrastructure exists.

There are no assurances that collected data will remain confined to transportation agencies. California already shares registration and traffic data with federal entities, insurers, and contractors. The inclusion of third party account managers expands exposure further.

The mileage based road charge converts driving from a private activity into a monitored transaction. It replaces an indirect tax on fuel with a direct tax on motion. The pilot phase establishes the foundation. Once scaled, participation will be embedded in vehicle registration and enforcement systems.

California presents the road charge as a revenue solution. Structurally, it establishes permanent monitoring tied to transportation. It links taxation to movement and identity. It collects and monetizes driver data statewide.

Freedom of movement and mandatory reporting cannot coexist. When travel must be measured, declared, and billed, participation becomes assumed and refusal becomes penalized.

References:

California Legislature. Senate Bill No. 1077 — Road Usage Charge Pilot Program.

Chaptered September 29, 2014, as Chapter 835, Statutes of 2014.

👉 https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=201320140SB1077

California Legislature. Senate Bill No. 339 — Road Charge Pilot Program.

Chaptered September 24, 2021, as Chapter 308, Statutes of 2021.

👉 https://leginfo.legislature.ca.gov/faces/billTextClient.xhtml?bill_id=202120220SB339

California Road Charge Program (Official Public Portal).

Public engagement site with pilot information, FAQs, and legislative background.